How to appoint Tax Agent for my SDN BHD

How to appoint tax agent for my SDN BHD (or PLT)?

1st thing first, are you the Director of the Company (Sdn Bhd or Partner of PLT)?

Only Director can start this procedure.

What are the proof that your are Director of the company?

1. Form 49 (if company is incorporated before 2017) and no other changes;

2. Section 68 (Annual Return)- latest.

3. Section 14 (if company is incorporated after 2016) and appointed as first director; OR

4. Section 58 (if appointed as Director after incorporation)

Best document will be ... the available document.

Click to login >>

After login to MyTax

Go to Profile

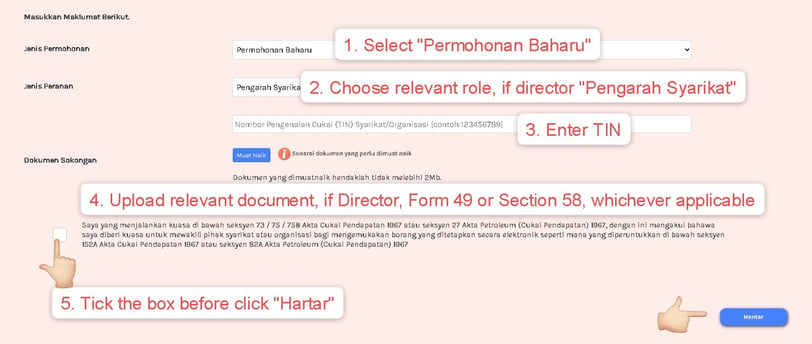

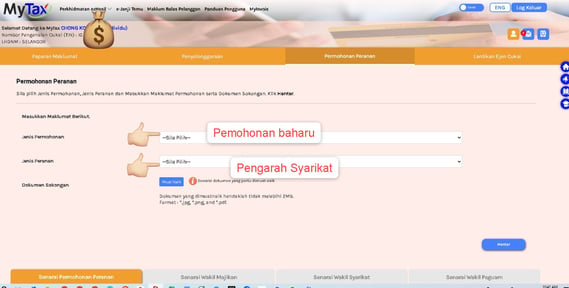

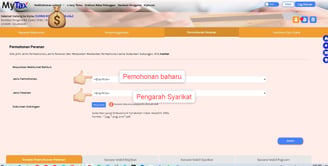

Choose "Permohonan Peranan"

Choose "Pemohonan baharu"

Choose "Pengarah Syarikat"

Enter company numbers

Upload document mentioned above.

Skip this step if the Company already in your MyTax.

For some tax payer, company added automatically into their MyTax.

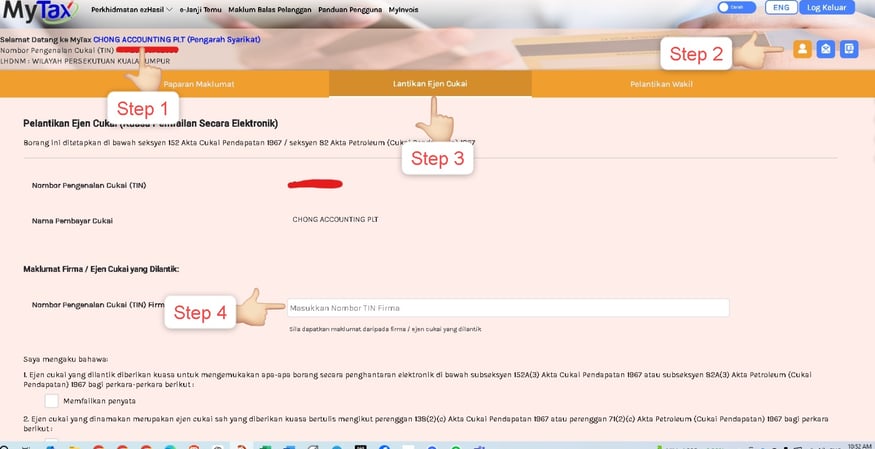

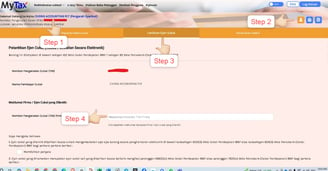

Once the company in your MyTax

Select company

Go to "Profile"

Choose "Lantikan Ejen Cukai"

Enter TIN (Nombor Pengenalan Cukai

or Tax Identification Number)

Cnps Tax Advisory Sdn Bhd

TIN = 26577519010

Where to click?

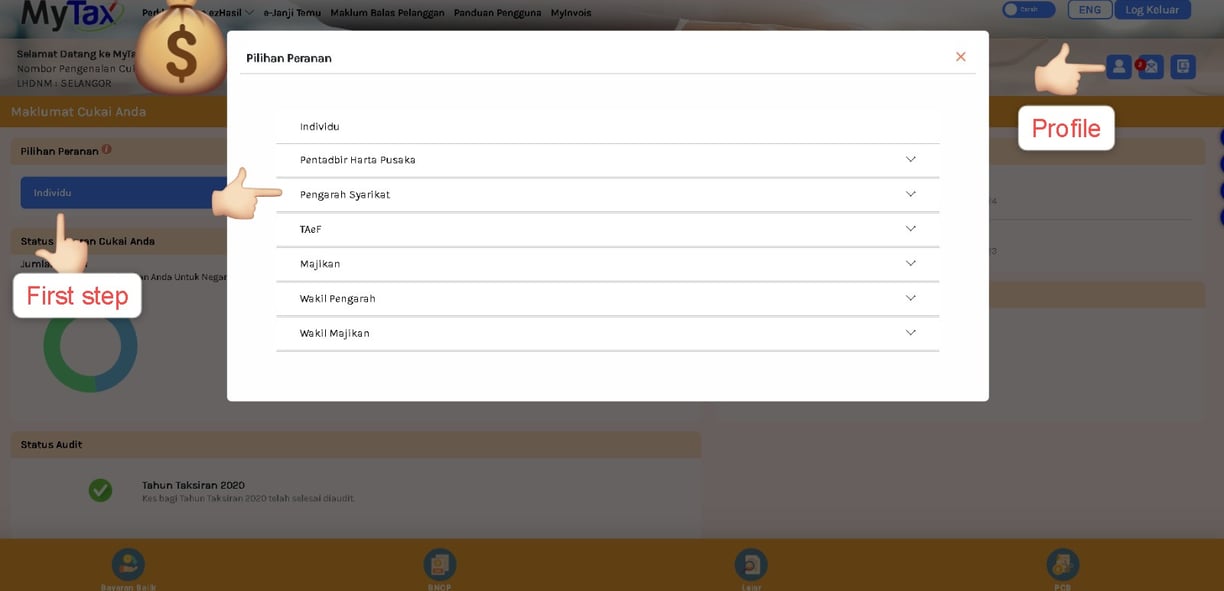

First Step - Choose Company - "Pilihan Peranan"

"Profile" on top right hand icon